I’ve always been environmentally conscientious thanks to freshmen orientation week at Colorado College where they drilled into our heads that we were all a part of the problem, and the solution, to natural resource conservation. As a result, I turn off the sink if I see it running unnecessarily in a public bathroom and I make a point of turning off all of the lights in a hotel room before I leave. I’m not paying for those resources directly out of my pocket, nor do I see an immediate tangible benefit, but I know it’s the right thing to do for the environment, and ultimately impacts me and future generations.

I’ve always been environmentally conscientious thanks to freshmen orientation week at Colorado College where they drilled into our heads that we were all a part of the problem, and the solution, to natural resource conservation. As a result, I turn off the sink if I see it running unnecessarily in a public bathroom and I make a point of turning off all of the lights in a hotel room before I leave. I’m not paying for those resources directly out of my pocket, nor do I see an immediate tangible benefit, but I know it’s the right thing to do for the environment, and ultimately impacts me and future generations.

I thought about what drives my behaviors as I was learning about a recent report released regarding consumer preferences in public health care price comparison sites like the Shop for Care page on CIVHC’s website. The report found that consumers are only concerned by how much they will have to pay out of pocket, and are less concerned with the total price they will pay in combination with their health insurance company.

The CIVHC public reporting team made the deliberate decision NOT to provide patient estimates and instead provide the total amount patients and their health insurance companies could expect to pay, for several important reasons:

- Prices are Personal: Aggregate claims data (from the Colorado All Payer Claims Database) is great at providing estimates of total prices across all payers or all patients or both, but what you will actually pay out of pocket is personal to your unique coverage and plan design.

- Variation is in the Total: The total price paid is where the significant variation in prices exists (up to $35K for knee replacement across all CO facilities!).

- Enables Negotiations: If you have to pay out of pocket or think your bill was incorrect, understanding the health plan negotiated rate is a good baseline to discuss prices with your provider, and

- Total Price Drives Future Price: Perhaps most importantly, the total price you and your insurance company paid is what drives insurance premiums rates for future years.

Let’s consider each of these areas in more detail.

Prices are Personal.

As individuals, we each have unique health insurance plan benefits and coverage. As an example, at CIVHC, many of us have elected to take our Humana employer-based coverage, but we have the option to choose from multiple plan designs with varying copays, deductibles and maximums. If my coworker and I both had an MRI at the same place, the claims that get submitted to the CO APCD might indicate that I was responsible for $20, and my coworker on a different plan had to pay $100. If we took the average and estimated the “typical” patient cost to be $60 on our website, we might be annoyed because the estimate was inaccurate for both of us. Based on this fact and the experience of others like CompareMaine.org who also use an APCD for their shopping tool, providing out of pocket estimates using an APCD can be more confusing than helpful, so we instead recommend consumers contact their health insurance company to find out specific prices once a few potential providers have been selected.

Variation Exists in the Total.

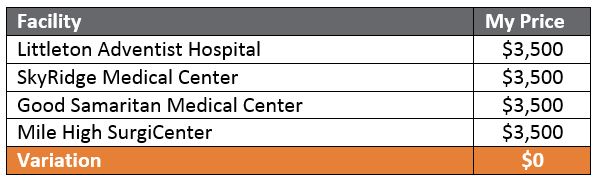

Let’s assume based on my MRI that I need a knee replacement and I have a $3,000 deductible, a $500 copay, and no co-insurance. If I found a site that could accurately estimate my price and that’s all I cared about, the results would indicate there is no difference in price between facilities:

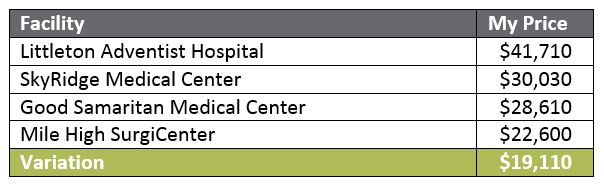

When in reality, the variation in prices associated with those facilities based on our website is almost $20,000:

Enables Negotiations:

I’m lucky to have insurance, but if I didn’t, I could look at the total price health insurance companies negotiate to understand what might be a reasonable price I might expect to pay. Similarly, if I got a bill that seemed really expensive compared to my expectations, I could use the “typical price” information to contact the provider and ask questions about my bill. In fact, we’ve heard from at least one Coloradan who got a $16,000 bill for an imaging service and was able to get reduce it to $2,000 using the average statewide payment for the same service.

Total Price Drives Future Price:

This is where – wait for it – we get back to my original analogy regarding making decisions based on a higher purpose that could ultimately lead to creating a better result more personal to you. If I make the decision to go to Mile High SurgiCenter and save $19,000 between what my health insurance company and I have to pay, that decision reduces health care expenditures in general. And, it actually may have a more immediate impact on my finances as future premiums are based on how much our insurance company paid for services in previous years. If we’re all making smart decisions based on the total price, we could collectively contribute to driving down prices across the state and nation.

I don’t blame the consumers who were interviewed for being primarily concerned about their out of pocket price. Until I started seeing the variation in total price between health care providers and began connecting the dots on how those prices paid impact costs and premiums, I had no idea I should care either. It’s going to take a concerted social effort to educate consumers that they should pay attention to totals in addition to what they have to pay. Similar to education concerning natural resources, it’s just a matter of raising awareness, and pretty soon the majority of us will be shopping based on the total price – right after we turn off that running faucet.

By Cari Frank, MBA, CIVHC’s VP of Communication and Marketing