The Center for Improving Value in Health Care (CIVHC) released a new health care payment comparison tool showing how much commercial health insurers pay hospitals and Ambulatory Surgery Centers (ASCs) compared to Medicare payments. The analysis reveals that while commercial insurers still pay hospitals two to six times Medicare rates, payments compared to Medicare are going down across all facility types statewide.

The tool was developed using 2019-2022 health insurance payment data in the Colorado All Payer Claims Database (CO APCD) in combination with Milliman's Medicare Repricer software. The findings offer insight into how commercial payments compare to Medicare for hospital and non-hospital care. Using Medicare payments as a benchmark to understand how much commercial payers pay facilities offers a standard way to evaluate variation in health care spending.

Medicare payments are considered a reasonable benchmark because they are updated annually and take into consideration a variety of factors including where the facility is located, and how much care the facility provides to publicly insured and uninsured patients.

This new tool and others compare commercial payments to Medicare, often called Medicare reference-based prices, and are being used by state agencies, payers, hospitals and others addressing health care affordability. Similar data is also being used by large employers and purchasing alliances to negotiate facility payments and reduce health care premiums and spending.

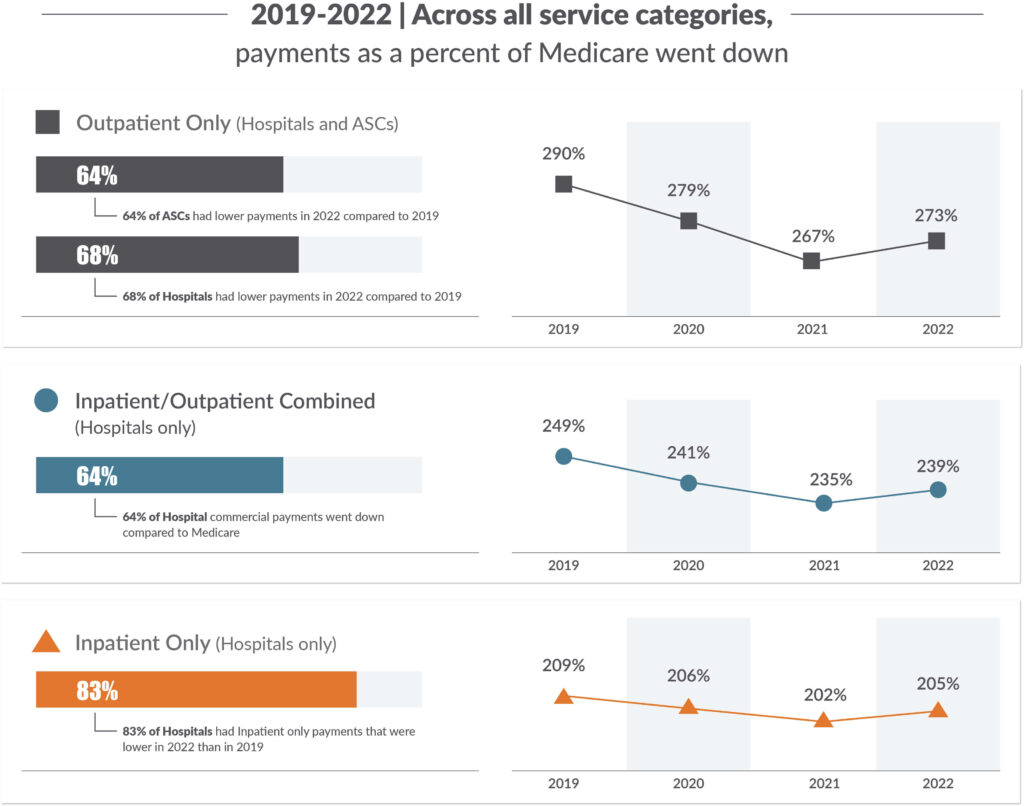

As a result of this work and other efforts to reduce health care spending, across all service categories, commercial payments as a percent of Medicare spending went down 4% from 2019 to 2022 in Colorado. In 2022, the vast majority of individual hospitals had lower payments for inpatient services (83%) and outpatient services (68%) compared to 2019. The majority of ambulatory surgery centers (64%) also had lower commercial payments as a percent of Medicare in 2022 compared to 2019.

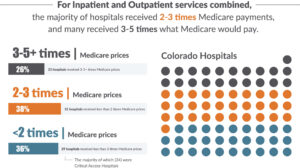

In spite of overall positive trends in lower commercial payments, 21 hospitals (26%) were paid 3-5 times what Medicare would pay for inpatient and outpatient services combined, and half of the 80 hospitals evaluated were paid 3-6 times Medicare prices for outpatient services only.

“It is encouraging to see a statewide trend of lower health care costs across Colorado, but this analysis shows that we still have opportunities to reduce spending and spending variation at the individual facility level,” states Kristin Paulson, CIVHC President and CEO. “Using Medicare data to understand commercial payments provides a standard baseline for comparison that can be leveraged to make care more affordable for Coloradans.”

Overall Colorado Findings

- Hospital Inpatient/Outpatient Services 2022:

- Payments were 2.4 times Medicare rates

- The majority of hospitals (78%) received 2-5 times Medicare rates

-

- 2019-2022 Trends: Decreased from 249% to 239%

- Hospital Inpatient Services 2022:

- Payments were 2 times Medicare rates

- 2019-2022 Trends: Decreased from 209% to 205%

- Hospital and ASC Outpatient Services 2022:

- Combined Hospital/ASC payments were 2.7 times Medicare rates

- ASCs: The majority of ASCs (72%) received less than double Medicare rates

- Hospitals: The majority of hospitals (69%) received 2-6 times Medicare rates

-

- 2019-2022 Combined Trends: Decreased from 290% to 273%

Trends and Geographic Variation (2022 compared to 2019):

- Statewide: Payments decreased by 4%

- Division of Insurance Regions: West, Colorado Springs and Pueblo DOI regions had increases in payments compared to Medicare while all other regions decreased. Fort Collins decreased most significantly at 13%.

- Individual Hospitals:

- 64% of hospitals had a decrease in inpatient/outpatient combined payments

- 83% of hospitals had lower inpatient only payments

- 68% had lower outpatient only payments

- Ambulatory Surgery Centers: 64% of ASCs had lower outpatient payments

It is important to note that CIVHC also partners with RAND Corporation to provide claims from the CO APCD for their nationwide analysis of Medicare reference prices. Their recent study places Colorado in the top ten highest states for inpatient and outpatient combined payments. To conduct state by state comparisons the RAND study uses a different methodology than the CIVHC analysis. As a result, not as many claims from the CO APCD are included in the RAND study, and statewide and individual facility data may differ between the two analyses.

CIVHC plans to update the Medicare Reference Based Price tool on an annual basis to help employers, state agencies and others to better understand commercial payments and continue to seek ways to make health care more affordable.

For more detailed information and to access to the full report with the named hospital and ASC results and the associated infographic, visit www.civhc.org.