The Center for Improving Value in Health Care (CIVHC) has released an update to its health care payment comparison tool showing how much commercial health insurers pay hospitals and Ambulatory Surgery Centers (ASCs) compared to Medicare payments. The analysis reveals commercial insurers still pay hospitals two to five times Medicare rates, continuing previous years’ trends.

The tool was developed using 2019-2023 health insurance payment data in the Colorado All Payer Claims Database (CO APCD) in combination with Milliman's Medicare Repricer software, which allows for the comparison of provider payments to Medicare benchmarks. The findings offer insight into how commercial payments compare to Medicare for hospital and non-hospital care. Using Medicare payments as a benchmark to understand how much commercial payers pay facilities offers a standard way to evaluate variation in health care spending.

Medicare payments are considered a reasonable benchmark because they are updated annually and take into consideration a variety of factors including where the facility is located, and how much care the facility provides to publicly insured and uninsured patients.

“Colorado has made great strides toward transparency, and tools like this are essential for understanding the real drivers of health care costs. By comparing commercial payments to a consistent standard like Medicare, we can support better decision-making across the system—from policy to purchasing—and help move toward more equitable and sustainable health care for everyone in Colorado.”

Kristin Paulson, JD, MPH,

This new tool and others compare commercial payments to Medicare, often called Medicare reference-based prices, and are being used by state agencies, payers, hospitals and others addressing health care affordability. Similar data is also being used by large employers and purchasing alliances to negotiate facility payments and reduce health care premiums and spending.

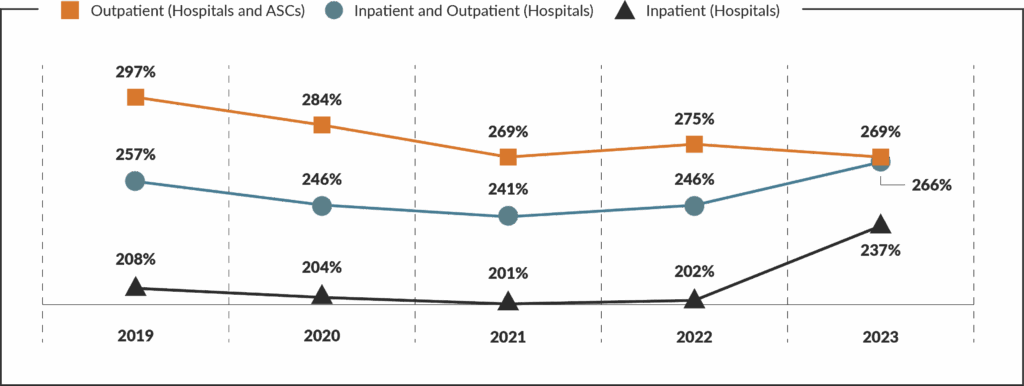

From 2019 to 2023, commercial payments as a percentage of Medicare spending in Colorado increased by 9%. In 2023, across both inpatient and outpatient hospital services, most hospitals received payments from commercial insurers that were two to three times higher than Medicare rates, with many receiving three to five times more. In contrast, payments to Ambulatory Surgery Centers (ASCs) for outpatient services declined significantly, dropping by 28% over the same period.

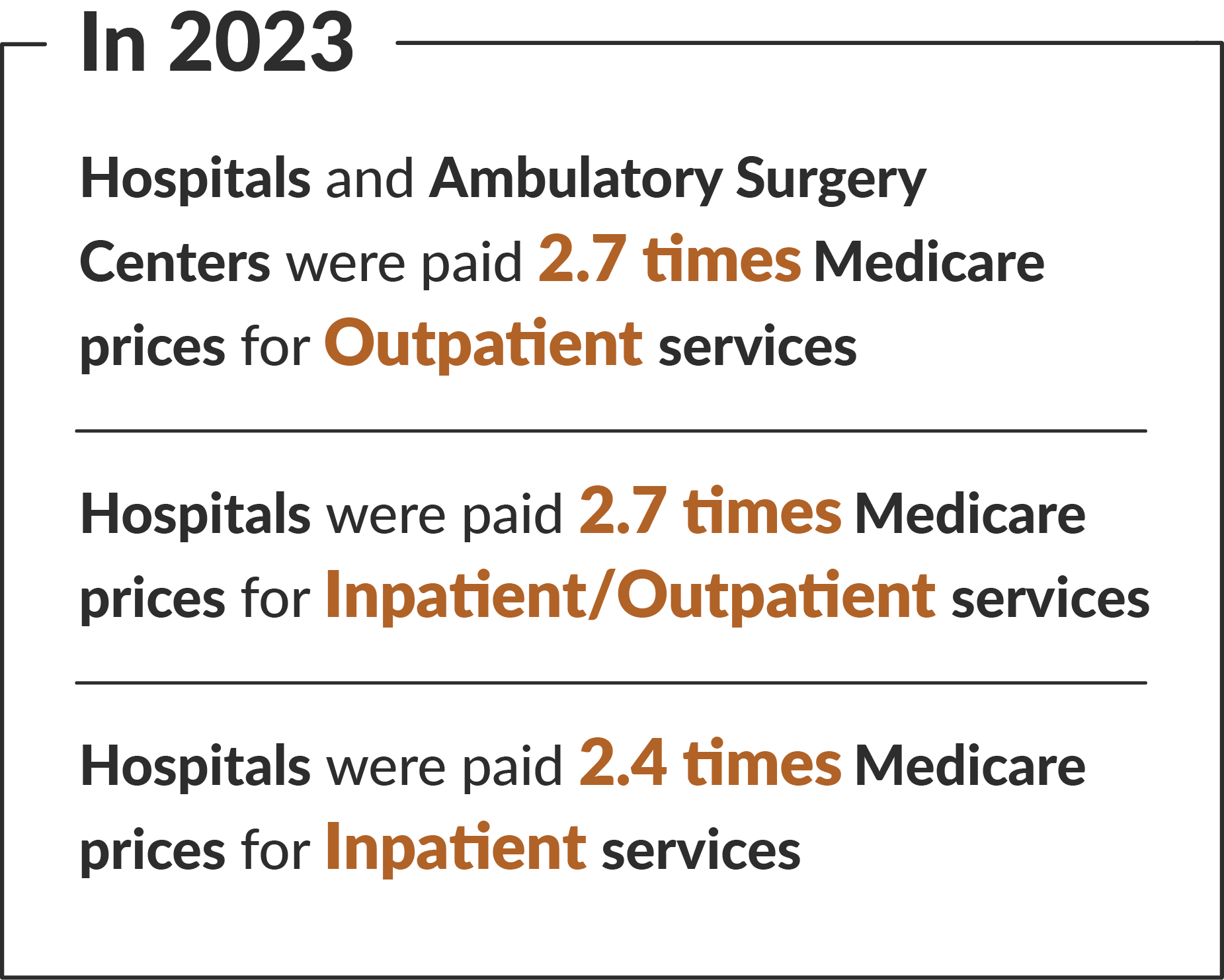

- Hospital Inpatient/Outpatient Services 2023:

- Payments were 2.7 times Medicare rates

- The majority of hospitals (67%) received 2-5 times Medicare rates

- 2019-2023 Trends: Increased from 257% to 266%

- Hospital Inpatient Services 2023:

- Payments were 2 times Medicare rates

- 2019-2023 Trends: Increased from 208% to 237%

- Hospital and ASC Outpatient Services 2023:

- Combined Hospital/ASC payments were 2.7 times Medicare rates

- ASCs: The majority of ASCs (73%) received less than double Medicare rates

- Hospitals: The majority of hospitals (70%) received 2-6 times Medicare rates

- 2019-2023 Combined Trends: Decreased from 297% to 269%

- Division of Insurance (DOI) Regions: East, Greeley and Ft. Collins DOI regions had decreases in payments compared to Medicare, while all other regions had increases. Fort Collins decreased most significantly at 13%. The West had the most significant increase at 29%.

- Urban and Rural:

- In urban communities, 94% of hospitals received commercial payments that were 2-5 times higher than Medicare rates.

- In rural communities, 61% of hospitals received payments that were less than double the Medicare rates.

CIVHC updates the Medicare Reference Based Price tool on an annual basis to help employers, state agencies and others to better understand commercial payments and continue to seek ways to make health care more affordable.

For more detailed information and to access to the full report with the named hospital and ASC results and the associated infographic: