Recently, the Center for Improving Value in Health Care (CIVHC) released an updated Medicare Reference Based Pricing Analysis, the final analysis in the Affordability Dashboard. As with the other analyses on the dashboard, Medicare Referenced Based Pricing is another tool providing insight on ways to approach lowering health care costs in Colorado.

The Medicare Reference Based Pricing analysis shows what commercial health insurance companies and patients pay hospitals for both inpatient and outpatient services using Medicare rates for those same services as a benchmark, or reference point. The analysis finds that while payments vary widely across Colorado hospitals, average payments considerably outpace national averages for those services.

Medicare v. Commercial Payments

Medicare Reference Based Pricing uses Medicare payments as a benchmark to show the comparative costs payed by commercial payers for services. While it is important to note that the report does not state the dollar figure Medicare might charge for these services, it gives insight into the wide variance paid by public vs. private payers for the same services at the same hospital.

Commercial payers set prices with hospitals through extensive contract negotiations, and if they are able to agree to a contracted price, a hospital will join a health plan’s network. However, in the negotiation process payers typically lack insight into what prices are being agreed to during other negotiations between hospitals and payers and how the contracts compare.

Comparatively, Medicare does not enter into any type of negotiation with providers and rates are instead set by the Centers for Medicare and Medicaid Services (CMS), which establishes a “base rate” based on legislation and Congressional funding. This rate is adjusted based on factors such as geographical market differences, wages, access to care, etc.

Understanding how their paid rates compare to those paid by Medicaid can be used as an important tool for private providers and facilities to determine if the costs they pay are reasonable and has proven to be an effective strategy in negotiating lower rates and designing policies to reduce health care costs.

Medicare Reference Pricing in Colorado

CIVHC’s Medicare Reference Based Pricing report uses Colorado All Payer Claims Database (CO APCD) to show what commercial health insurance companies pay hospitals for both inpatient and outpatient services as a percent of Medicare. The data is available by both Colorado Department of Insurance (DOI) region and on a county level, as well as on a per-hospital basis. The report also incorporates measurements on patient experience, overall hospital quality, and comparisons to the previous year.

The report is based on a nationwide analysis by the RAND Corporation that included CO APCD claims from 2018 to 2020. CIVHC’s analysis provides more insight into RAND’s reporting, allowing for the DOI and county breakdowns. When viewing the analysis, it is necessary to consider that not all CO APCD claims met the minimum standards to be matched and included in the analysis, and therefore the volume of claims included per hospital is lower than the actual number of inpatient discharges and outpatient visits. To learn more, read CIVHC’s report methodology and download the full RAND methodology and dataset.

Analysis Findings

Medicare rates in this report are equal to 100%, where 100% is the baseline. So, a hospital with a 100% of Medicare result would pay prices equal to those Medicare pays. Therefore, a hospital with a 300% of Medicare rate result, for example, would pay 3x more than Medicare rates.

CIVHC’s analysis found that Colorado hospitals are paid an average of nearly three times more (283%) than Medicare rates for commercially insured inpatient and outpatient services combined, and for just outpatient services, they are paid an average of over three times Medicare rates (304%).

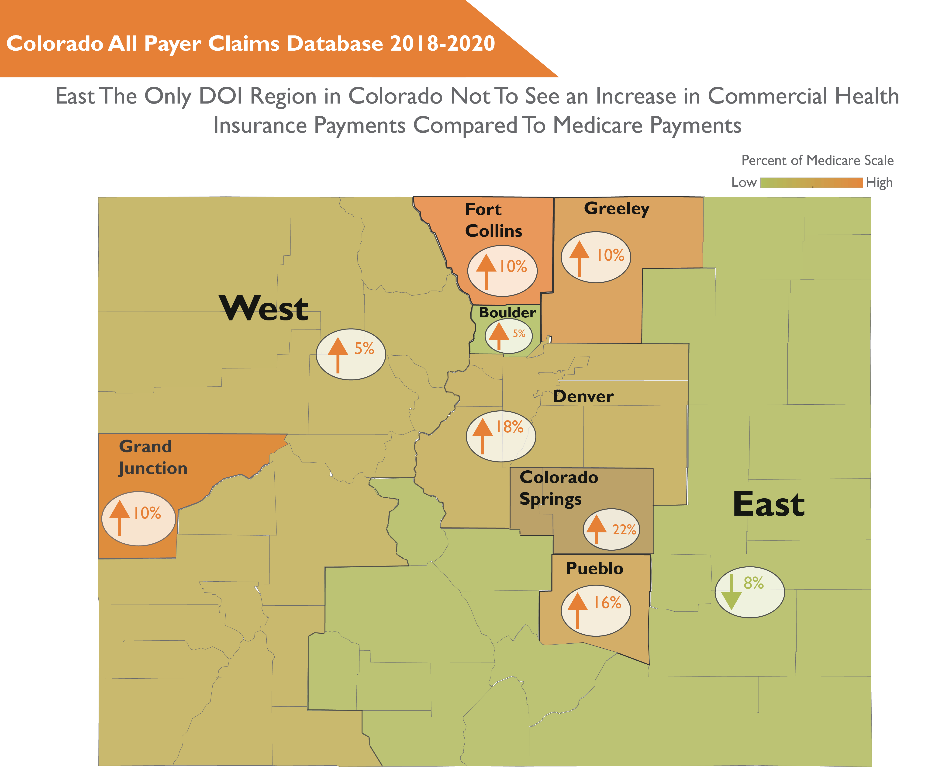

From 2018-2020, all but one of the nine DOI regions in Colorado experienced increases in hospital prices and average prices in every region were higher than the national average of 224%, which is a decrease from last year’s national average.

With this information, employers, commercial payers, legislators and other parties have a tangible metric to negotiate prices to reduce health care rates, strategize to move away from higher-paid hospitals and towards better-value providers, or develop intervening policy and legislation.

To view the full data set from CIVHC’s Medicare Reference Based Pricing Analysis, submit a short request to access the files here. Infographics providing additional insight at the DOI and named hospital levels are also available with the full interactive dashboard.