The Colorado All Payer Claims Database (CO APCD) contains over 1.3 billion claims, with more added every month. These claims are submitted by commercial health insurance plans, including Medicare Advantage, voluntarily submitted Employee Retirement Income Security Act (ERISA) and mandated non-ERISA self-insured employer plans, Medicaid, and Medicare Fee-for-Service (FFS). The CO APCD does not contain claims for people covered by Federal health insurance programs such as the Veterans Administration, TRICARE federal employees, or Indian Health Services, and does not include information for uninsured Coloradans.

The CO APCD holds information for over 70% of insured individuals in Colorado with medical coverage, representing over 5.6 million lives in total across all coverage types (medical, dental and pharmacy). As of this post, 33 commercial payers submitted claims in 2025 along with Medicaid and Medicare FFS.

This and the next two installments of the Query: CO APCD Data Quality series will focus on data submitted by payer line of business – commercial insurance, Medicaid, and Medicare (FFS and Advantage). The data in each line of business has different nuances that are helpful to be aware of when using the CO APCD. Data surrounding the contents of the CO APCD is available for download alongside the interactive CO APCD Insights Dashboard on civhc.org.

Payers v Submitters

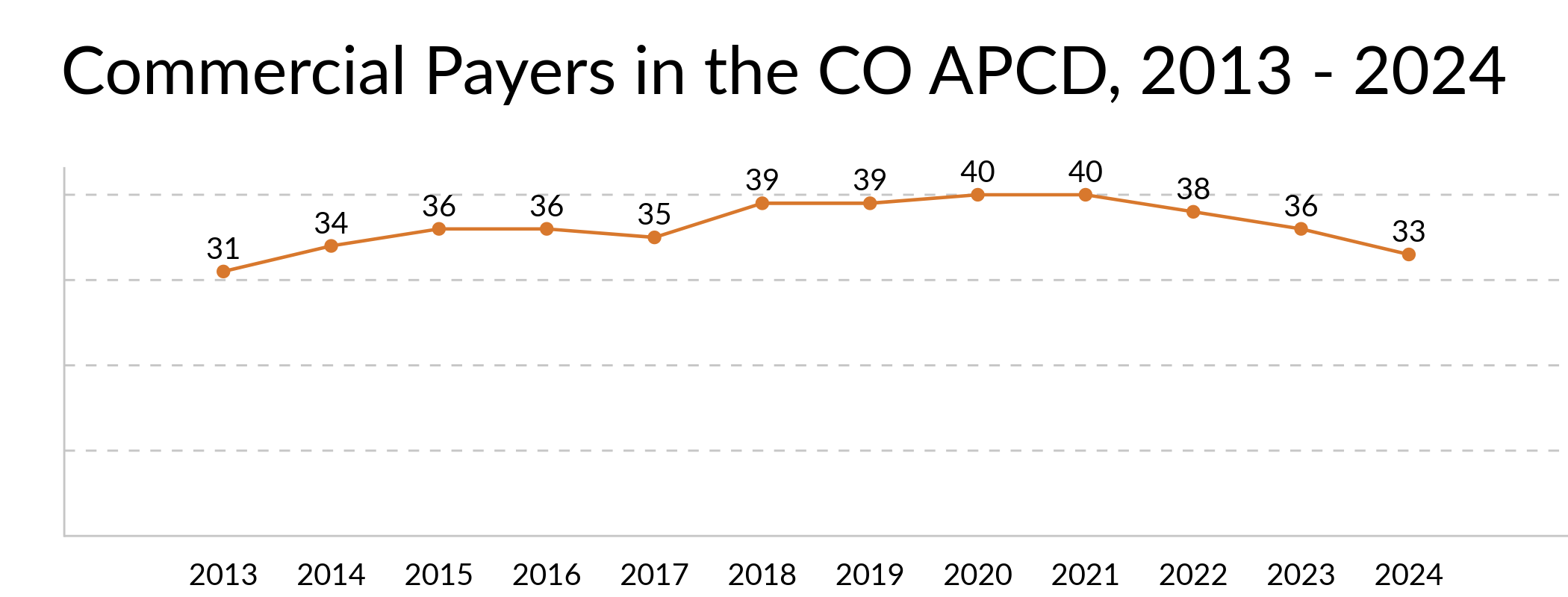

CIVHC began collecting claims in the CO APCD in 2012, with eight commercial payers plus Medicaid submitting information. Since then, the number of commercial payers has more than quadrupled. It is important to recognize that while many payers have multiple lines of business and submit them separately to the CO APCD, CIVHC counts and reports them as one “payer family” – or payer. For example, Aetna’s PPO, HMO and self-insured claims may be provided as separate submissions, but “Aetna” as the payer family category is counted as only one payer. When discussing the lines of business that make up a payer family, they are referred to as submitters. Thus, it is possible to have more submitters than payers in the CO APCD.

Commercially Insured Lives in the CO APCD

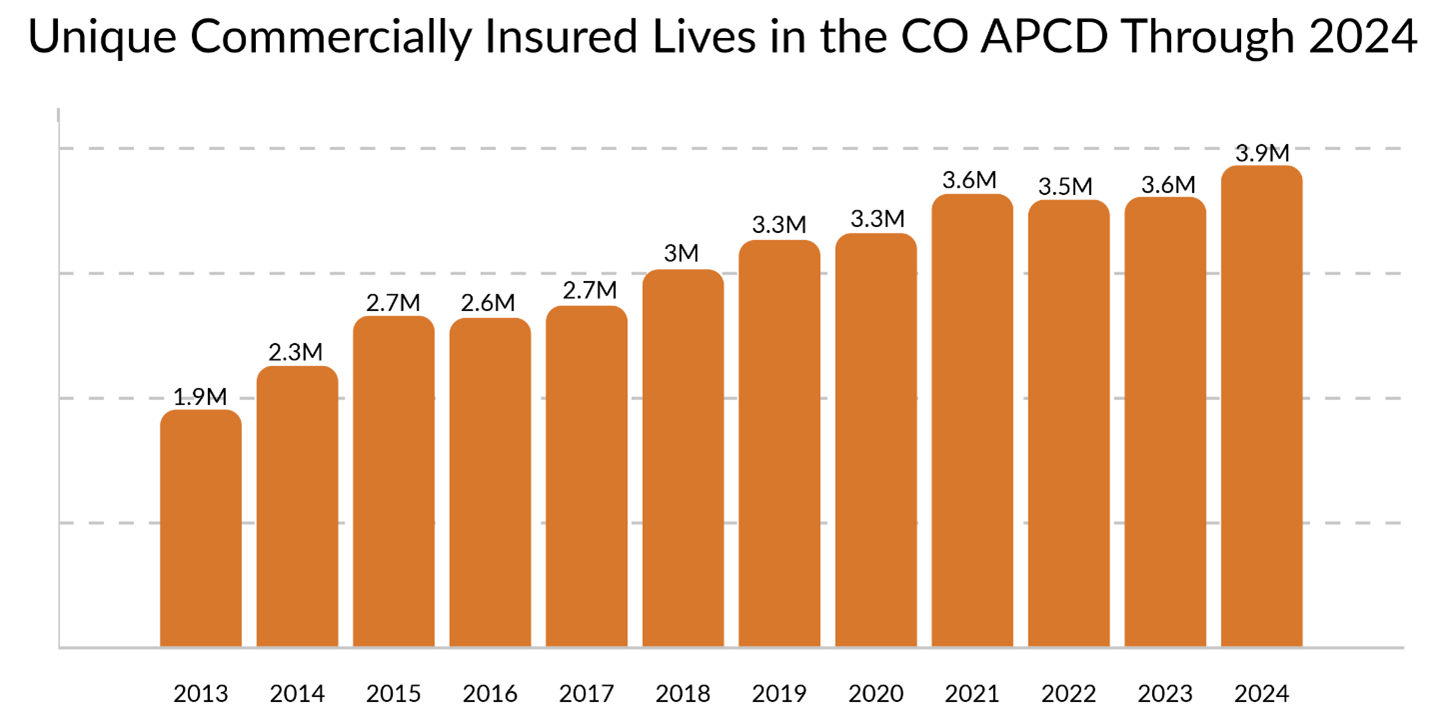

The number of commercial lives in the CO APCD increased by XX% between 2013 and 2024 and now represents over 3.9 million unique people. In the same time span, the CO APCD has collected over 7.6 million unique lives under commercial plans. According to the Insights Dashboard, individuals with commercial medical insurance represent 36% of covered lives reflected in the CO APCD, and according to Census data, individuals with commercial medical insurance make up approximately 23% of the total population statewide. CIVHC collects 100% of the fully insured and individually insured commercial lives, and approximately half of the self-insured employer-covered commercial lives (see below for more details). According to legislation, commercial insurers must submit data for all fully insured, individually insured, Medicare Advantage, and non-ERISA self-insured employer lives.

Self-insured Employers

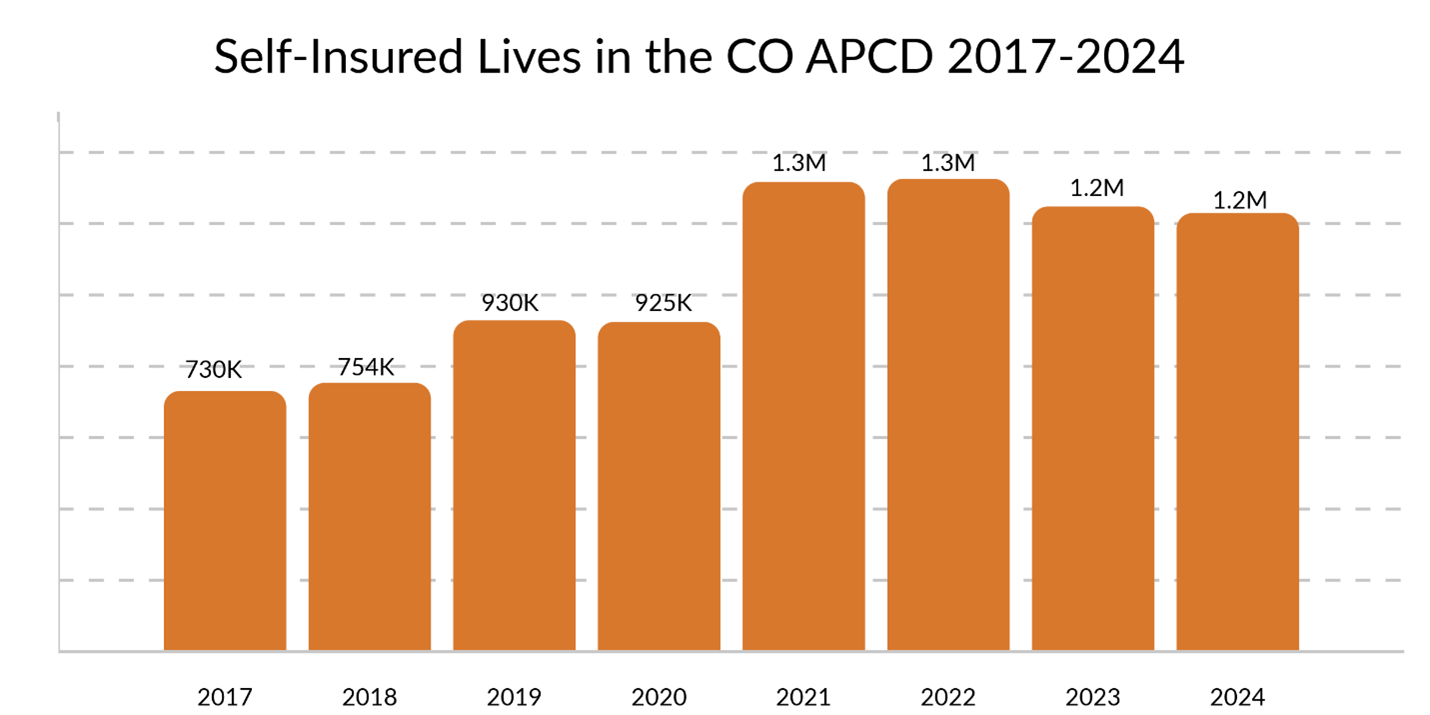

Self-insured employer claims are estimated to represent half of the total commercially insured lives in Colorado and CIVHC estimates that the CO APCD currently contains approximately 25% of ERISA self-insured lives and 50% of all self-insured lives, most of which are non-ERISA based self-insured employers. Due to a 2016 ruling by the United States Supreme Court, states cannot mandate submission of claims data from self-insured ERISA plans to APCDs.

However, the ruling does not impact the collection of data from non-ERISA self-insured employers or those ERISA-based employers who choose to submit claims to APCDs voluntarily. CIVHC continues to collect non-ERISA self-insured employer claims and conducts robust outreach to encourage voluntary submissions from ERISA-based employers.

As part of this outreach, CIVHC has partnered with different employer groups to ensure that businesses understand how CO APCD data can help them lower costs for their employees while continuing to offer high value care. A number of these groups have created employer alliances and bargaining collectives have negotiated ground-breaking contracts with facilities for their employees. The majority of self-funded employers that CIVHC has engaged are in favor of voluntarily submitting their claims to the CO APCD and understand how benchmarking data to compare their costs to others in their region provides them valuable information to use when it comes time to renew benefits and make changes to health plan designs.

In some cases, the obstacle to submission to the CO APCD is not the employer but the third-party administrator (TPA) or administrative service organization (ASO) that processes the claims on their behalf. Submission of claims to an APCD may not be in the service contract between the employer and the ASO/TPA and may, in fact, be prohibited in their provider network contracts. Additionally, there are no legal requirements for ASOs and TPAs to submit claims on behalf of the employers, even if it is requested. CIVHC has developed a step-by-step guide and resources for self-insured ERISA employers to use to assist them with voluntary submissions through their TPA or ASO.

For more information about commercial claims or other payers submitting to the CO APCD, please visit our CO APCD Insights Dashboard, or contact us at info@civhc.org.