Prescription drug spending is a leading contributor to rising health care costs across the United States. Increasingly, consumers, medical professionals, insurers, legislators, and other stakeholders are identifying rising prescription drug costs as a priority to address health care spending. According to a study released earlier this year, three in four Americans say prescription drugs are too expensive, and nearly one in three say they have neglected to take prescribed medications due to costs.

While prescription drugs become increasingly unaffordable to many Americans, the system through which they function is historically opaque. The Colorado All Payer Claims Database (CO APCD) is one of only a few APCDs in the country to collect data on prescription drug rebates in an effort to shed light on how dollars are exchanged in the system and the impact of rebates on prescription drug costs in Colorado. Further understanding prescription drug rebates and the role they play has been identified by Colorado legislators and other stakeholders as key to understanding the fuller picture of Colorado’s health care landscape and reducing costs.

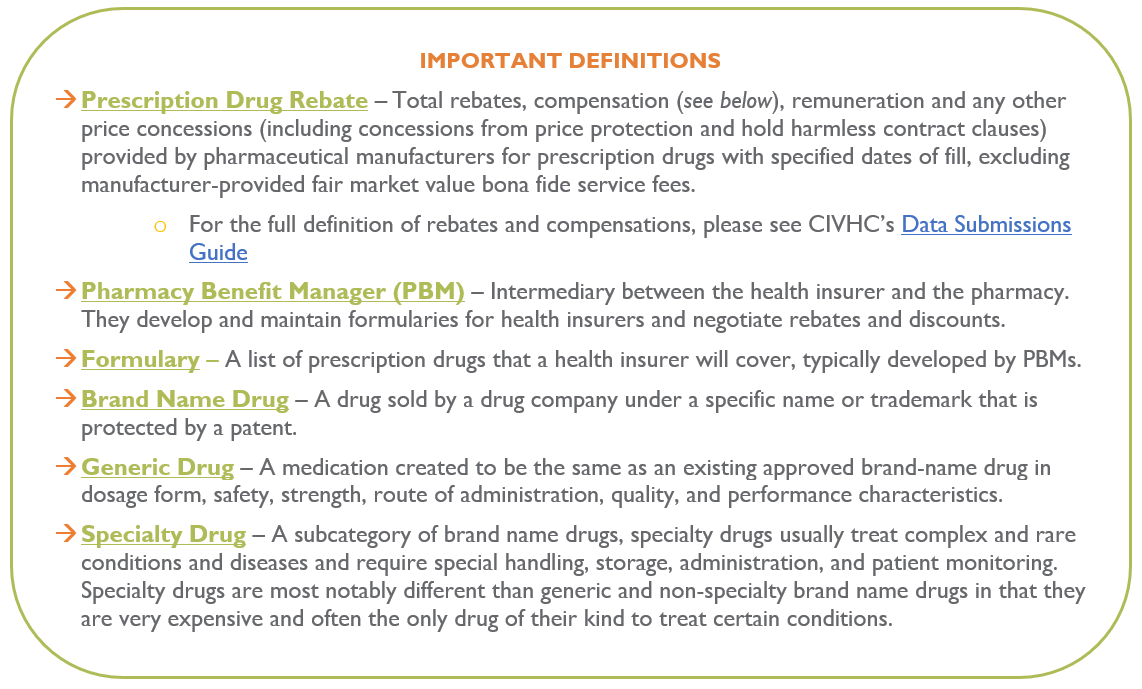

What is a Prescription Drug Rebate?

The exchange of dollars in the system of drug rebates is complex, and involves multiple parties including pharmaceutical manufacturers, health insurers, pharmacy benefit managers (PBMs), pharmacies, wholesalers, and patients.

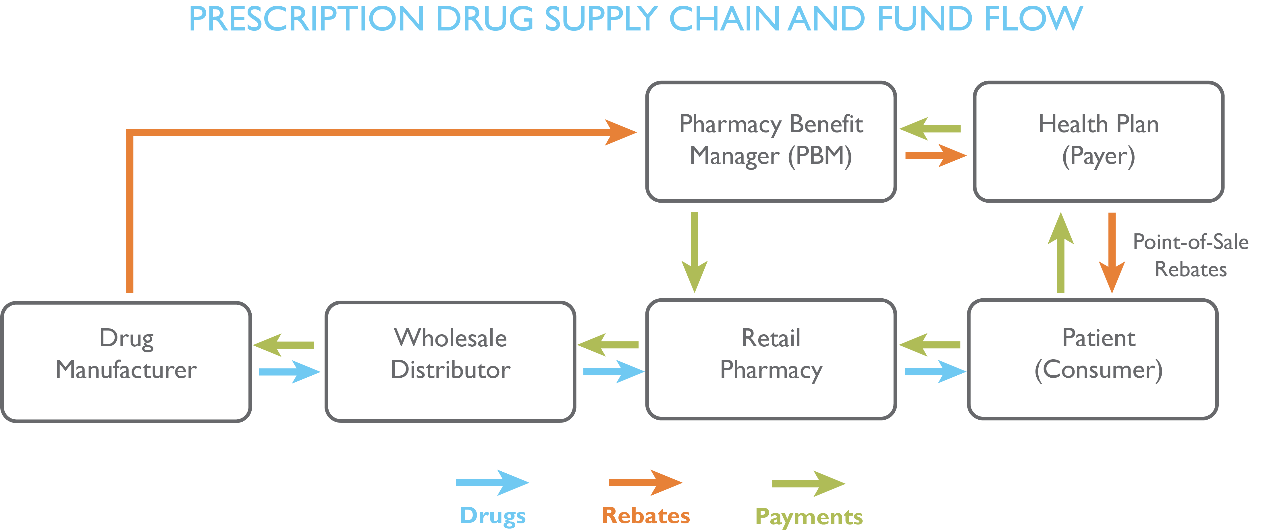

Drug manufacturers set prices and sell drugs to wholesalers, which then sell them to retail outlets, like a local pharmacy. Drug rebates refer to compensations provided by manufacturers to PBMs, typically negotiated between the buyer and payer (insurer or PBM). Rebates are typically provided by a manufacturer to a PBM, which in turn shares rebates with health insurance payers to help reduce the cost of specific drugs.

The graphic below illustrates the web of payments and services, including rebates:

Rebate payments typically function as a lever of negotiation by manufacturers with PBMs to earn favorable placement on the payer’s preferred drug list, or formulary, to increase the drug’s market share.

In effect, rebates reduce the cost of drugs to the PBM or health plan. Public payers like Medicare and Medicaid use drug rebates to reduce the overall cost of providing coverage. However, how commercial payers use rebates is unclear. Rebate savings can be shared to reduce premiums, providing an indirect benefit to consumers and employers. But because rebate contracts are kept as trade secrets, the flow of savings and payments is difficult to track, leaving it unclear how rebates are used and to whose benefit.

Prescription Drug Spending in Colorado

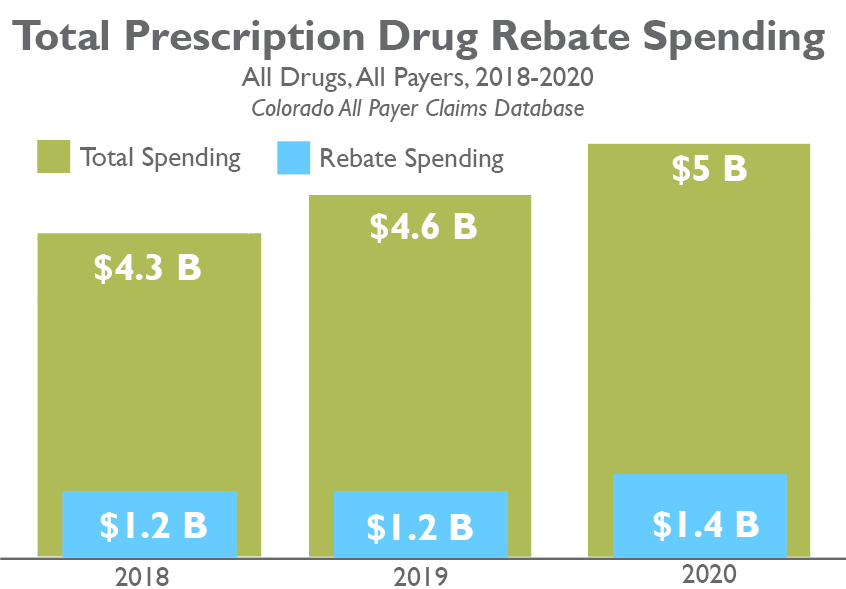

In an effort to start understanding the exchange of dollars in the system, and as part of state efforts to constrain health care costs, CIVHC began collecting drug rebate information in 2018. In April 2022, CIVHC released an updated prescription drug rebates analysis, part of the Affordability Dashboard. The report, accounting for drug information from 2018-2020 submitted by payers, shows that total prescription drug spending in Colorado increased by 16% without rebates.

Opponents of drug rebates argue that rebates may incentivize the prioritization of more expensive drugs like specialty and brand name drugs. The updated analysis shows that, from 2018 to 2020, total spending for commercial payers for brand specialty drugs increased by 33% and rebates for brand specialty drugs increased by 54%. These increases signal that rebates may potentially drive higher use of brand specialty drugs.

Colorado’s Efforts to Understand Prescription Drug Spending

Colorado policymakers continue to prioritize addressing the price of prescription drugs, supported by insights provided by CIVHC’s reporting to evaluate rebate trends and progress toward curbing costs of prescription drugs. In collaboration with CIVHC, the Department of Health Care Policy and Finance (HCPF) has taken a number of steps recently towards these goals. In January 2021, HCPF released the second edition of the Reducing Prescription Drug Costs in Colorado Report, using CO APCD data, and in June 2021 the creation of a Prescription Drug Affordability Board (PDAB) was approved through passage of SB21-175.

The PDAB creates upper payment limits for certain drugs, sets drug payment limits for manufacturers, and requires submission of more detailed prescription drug rebate information to the CO APCD. This year, Data Submission Guide (DSG) 13 adds two new file submissions to support this work: data to support the work of the PDAB to allow them to see the drugs accounting for the highest costs in Colorado and data regarding value-based pharmaceutical contracts (VBPC) to understand how prescription reimbursements are structured. Continued enhancement of data collected in the CO APCD will be critical to CIVHC supporting this state-led work.

In addition, new legislation was recently passed requiring health insurance payers to pass all rebates paid to health insurers and PBMs be passed on to employers and consumers. The bill also sets standards for “step therapy” to require patients are required to take a less expensive drug by payers before advancing to more expensive drugs. The legislation will take effect in 2023.

Additional Resources: