A new drug rebate analysis released by Center for Improving Value in Health Care (CIVHC) shows that prescription drug spending continues to grow in Colorado, and so do drug rebates for brand non-specialty and brand specialty drugs. Increases in both spending and the percent rebates of total spending lead to calls for more transparency around the impact drug rebates have on rising health care costs.

A recent national Kaiser Family Foundation poll showed that 40% of respondents are either “very worried” or, “somewhat worried” about being able to afford their rising prescription drug costs. Data from the Colorado All Payer Claims Database (CO APCD) show that from 2013 to 2019, prescription drug costs rose 87% per person per year.

Prescription drug rebates from manufacturers provide health insurers with some relief from rising costs, although they may also be contributing to overall increases in prices. Drug rebates refer to compensations provided by manufacturers to Pharmacy Benefit Managers (PBMs) which in turn share rebates with health insurance payers to help reduce the cost of specific drugs. Manufacturers provide drug rebates to PBMs in exchange for placing the drug on the payer’s preferred drug list or formulary, which increases the drug’s market share.

Public payers like Medicare and Medicaid use drug rebates to reduce the overall cost of providing coverage. However, it is less clear how commercial payers are using rebates. Drug rebates can reduce premiums and can be shared with their employer clients depending on the contract terms negotiated between the employer and their payer or PBM.

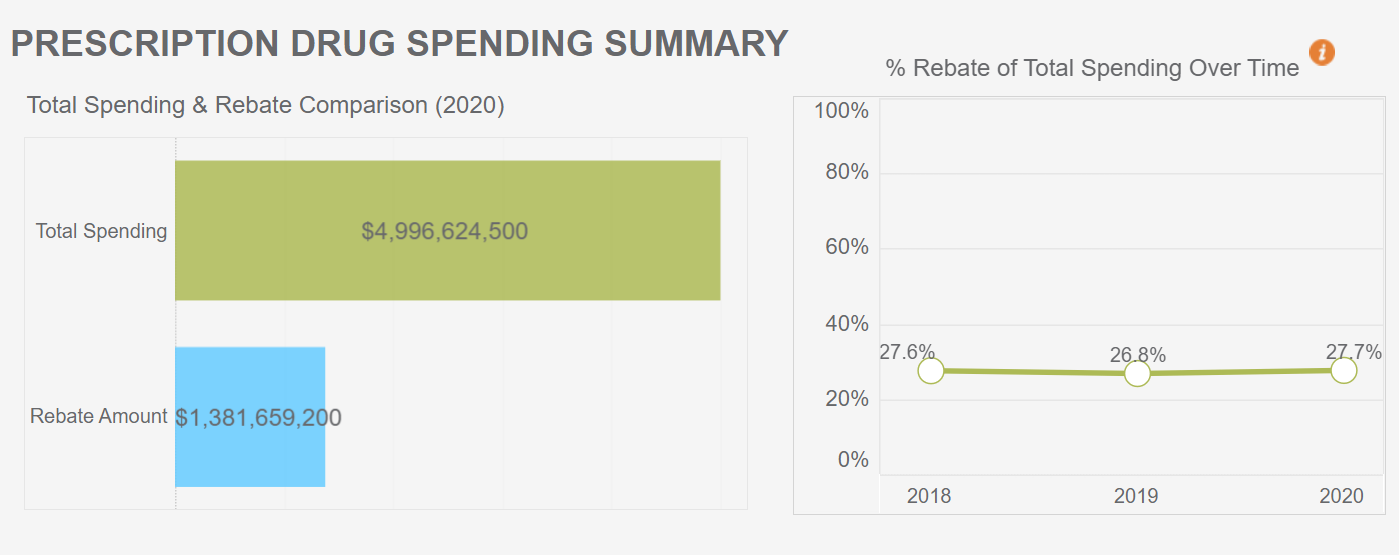

In the analysis of 2018-2020 drug rebate information submitted to CIVHC by health insurance payers in Colorado, total prescription drug spending increased by 16% from 2018 to 2020 without rebates. When factoring in rebates received, total spending on pharmaceuticals still increased by 16%. This indicates drug rebates are keeping pace with total pharmaceutical spending and have a no substantial impact on reducing overall spending.

Opponents of drug rebates argue that rebates may incentivize the use of higher-cost drugs like brand specialty drugs and that the savings are not being shared directly with consumers and employers. From 2018 to 2020, total spending for commercial payers for brand specialty drugs increased by 33% and rebates for brand specialty drugs increased by 54%. These increases signal that rebates may potentially drive higher use of brand specialty drugs.

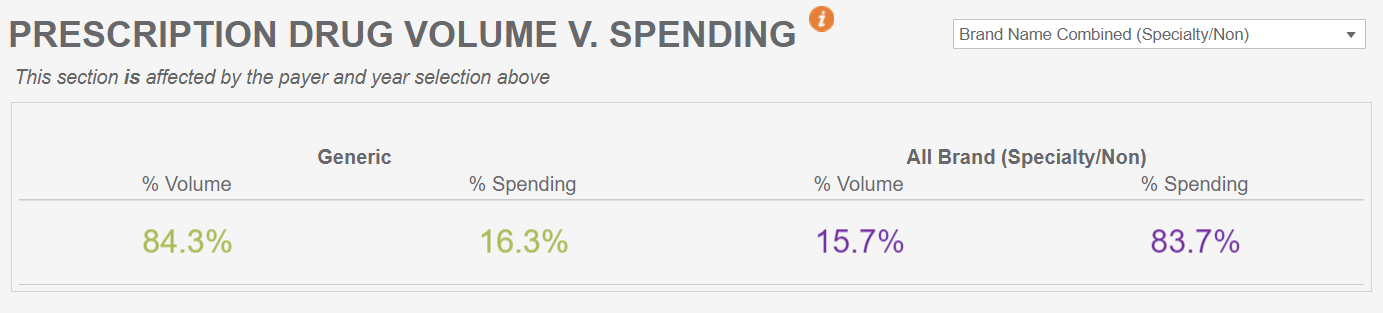

The analysis also shows that across all payers, while brand non-specialty and brand specialty drugs make up approximately 15% of the volume of drugs dispensed through pharmacies, they represent more than 80% of all pharmacy spending.

Additional insights from the 2020 data in the analysis includes:

- Across all payers and all drug types, 28% of total pharmacy spending comes back in the form of rebates.

- Rebates are highest across all payers for brand non-specialty drugs, with 44% of total pharmacy spending received in the form of rebates.

- Brand specialty and brand non-specialty drugs make up a small portion of the volume of claims filled in Colorado, but the majority of the spending.

To help stakeholders dig deeper into drug rebates, CIVHC released a full interactive drug rebate report as part of its Affordability Dashboard. This is the third cost-related topic to be added to the dashboard in addition to total cost of care and low value care. Users can view the new drug rebate data by payer type, drug type, and across time. In the future, CIVHC will be collecting more specific drug rebate information to support the work of the state Prescription Drug Affordability Board. Learn more about the work of the PDAB and CIVHC’s role in a recorded webinar.

For more information about this report and other reports available please visit our website at www.civhc.org or contact us at info@civhc.org.